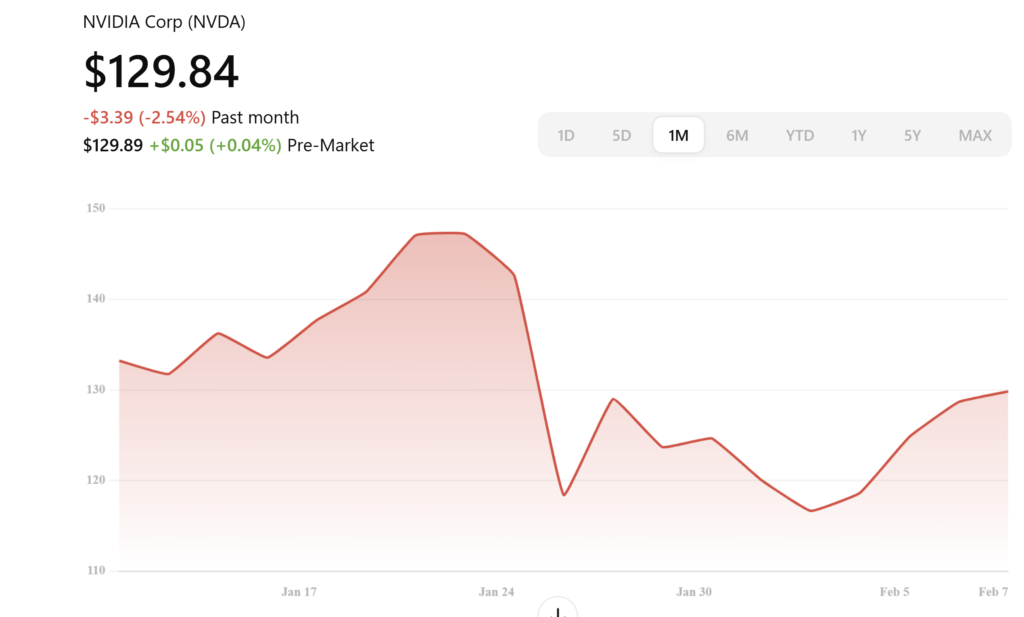

In late January 2025, Nvidia experienced a historic market downturn, shedding nearly $600 billion in market capitalization—the largest single-day loss in U.S. history. This dramatic decline was primarily triggered by the emergence of DeepSeek, a Chinese AI startup that unveiled advanced models claiming superior efficiency at reduced costs. Investors reacted swiftly, fearing that DeepSeek’s innovations could undermine Nvidia’s dominance in the AI hardware sector.

Compounding these concerns, the U.S. administration announced significant tariffs on imports from Canada, Mexico, and China, with retaliatory measures following suit. The technology sector, particularly companies like Nvidia with extensive global supply chains, faced potential disruptions and increased costs due to these trade tensions.

Despite these challenges, some analysts argue that the market’s reaction may have been excessive. They emphasize Nvidia’s robust position in the AI industry, highlighting its strong fundamentals and ongoing innovations. The recent downturn could present a strategic entry point for investors confident in Nvidia’s long-term trajectory.

As of February 10, 2025, Nvidia’s stock is trading at $129.84, reflecting a slight uptick from previous sessions. This modest recovery suggests that while recent events have introduced volatility, Nvidia’s foundational strengths continue to inspire investor confidence.

In conclusion, while Nvidia’s recent market loss was significant, it appears to be more of a temporary setback than a fundamental decline. The company’s resilience and strategic initiatives position it well to navigate current challenges and capitalize on future opportunities.